estate tax exemption 2022 build back better

The estimated 175 trillion bill proposes extending the. What is the transfer tax exemption for 2022.

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Gift and Estate Taxes Proposed Under the Build Back Better Act.

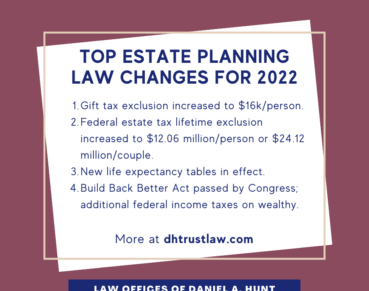

. Lowering the gift and estate tax exemptions seems a lock. Understanding the 2022 Estate Tax Exemption For 2022 the personal federal estate tax exemption amount is 1206 million. Even though the estate tax exemption would be cut by about 6 million the value of.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million. The BBBA proposal seeks to reduce these. A lot of farm operations are actually better off under the Democratic legislation he said.

The unified credit against estate and gift tax in 2022 will be. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. The base amount currently is 10000000 set in 2017.

The current version of the Build Back Better Act does not appear to include this provision but until the Act is signed into law. As passed by the House on November 19 2021 the Build Back Better Act does not include these earlier proposals. Its part of the larger Mesoamerican Barrier Reef.

Effective January 1 2022 the BBBA reduces the gift estate and GST tax exemptions from 11700000 per. Federal Estate Gift and Generation-Skipping Transfer Tax After December 31 2021. Estate Taxes One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for.

Trusts and estates lawyers and advisors have been keeping a close watch on recent developments regarding the tax proposals contained in HR. This exemption currently 117 million per donor and 234 million per married couple. There is another increase in the.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The federal estate tax exemption for 2022 is 1206 million. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to.

In short the proposed Build Back Better Act BBBA does the following. What is the transfer tax exemption for 2022. Under current law the estate and gift tax exemption is 117 million per person.

The federal estate tax exemption amount is still dropping on January 1 2026 from. Under the TCJA the exemption is scheduled to decrease to 5 million. On November 10 2021 the IRS announced that the 2022 transfer tax.

The Portability Election which allows a surviving spouse to use his or her deceased spouses unused federal estate and gift tax exemption is unchanged for 2022. As a result the gift estate and GST tax exemptions are each 117 million per person in 2021. The exempt increased from 117 million for.

One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. The BBBA proposes to reduce the federal estate and gift tax exemption from the current 117 million per individual to 5 million per individual indexed for inflation. The Build Back Better bill passed in the House of Representatives on November 19 2021.

Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. Fortunately all of the above failed when 2022 arrived. You can gift up to the exemption amount during life or at death or some combination thereof.

The proposal seeks to accelerate that reduction. 5376 commonly known as.

2022 Updates To Estate And Gift Taxes Burner Law Group

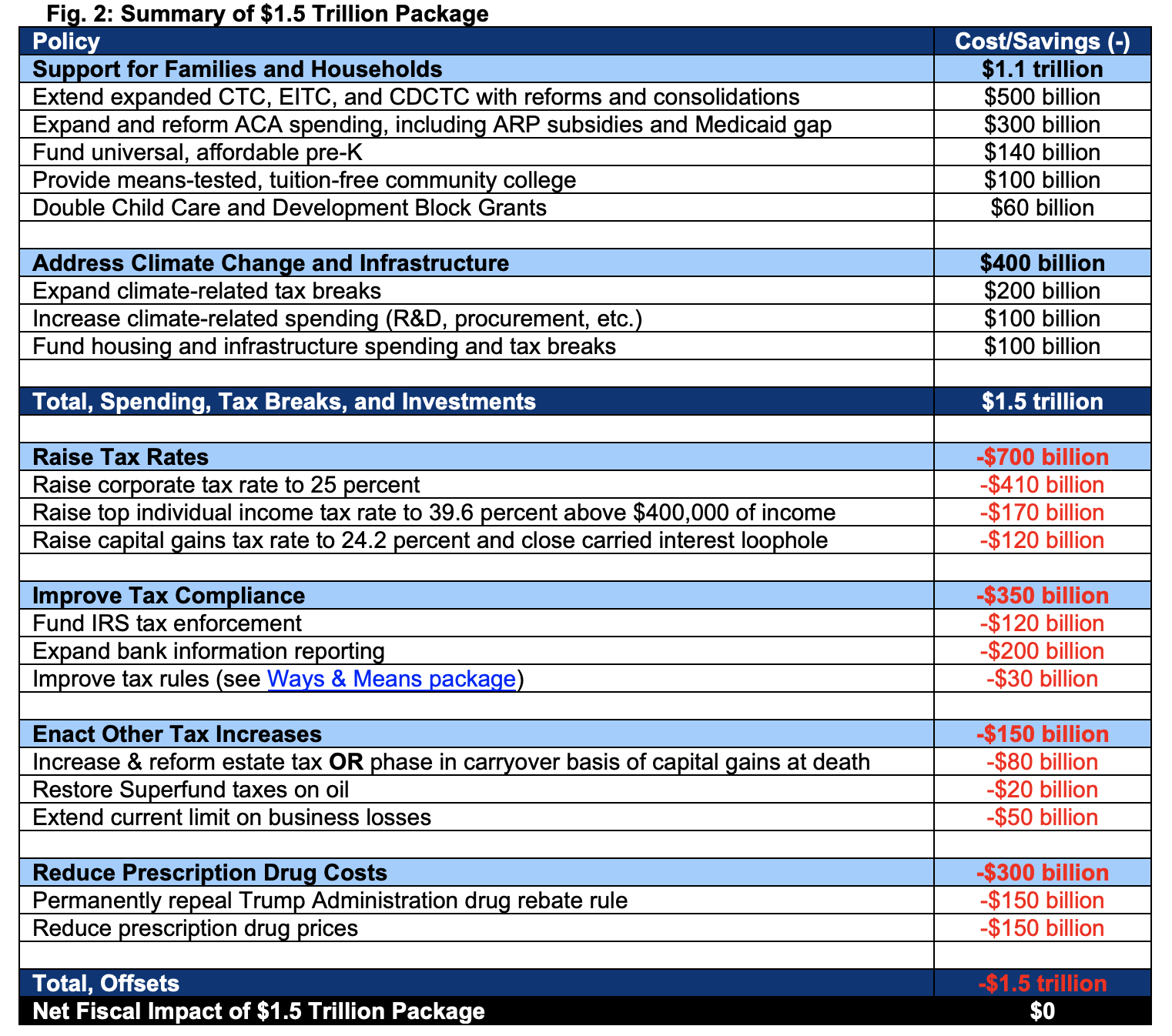

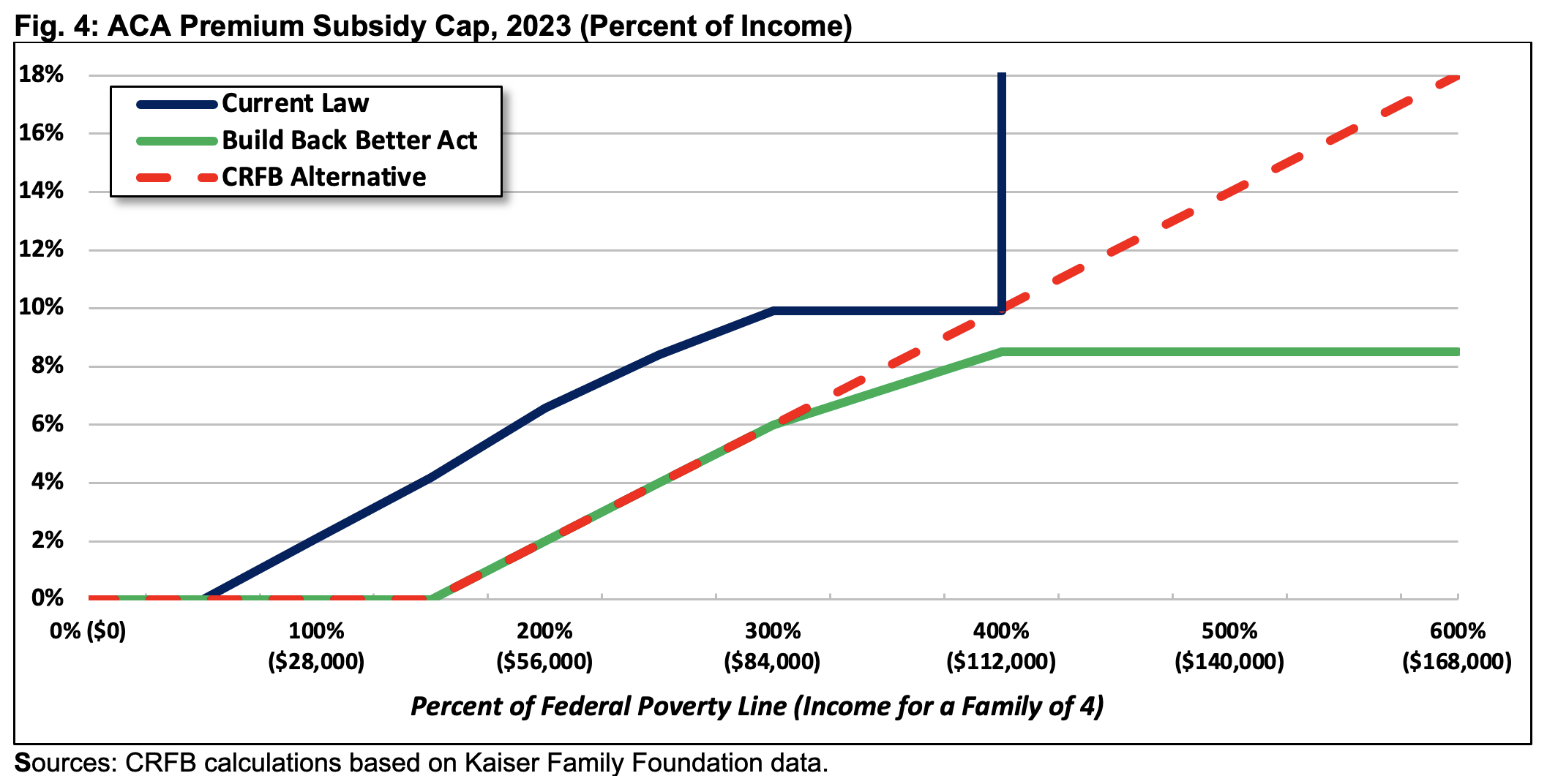

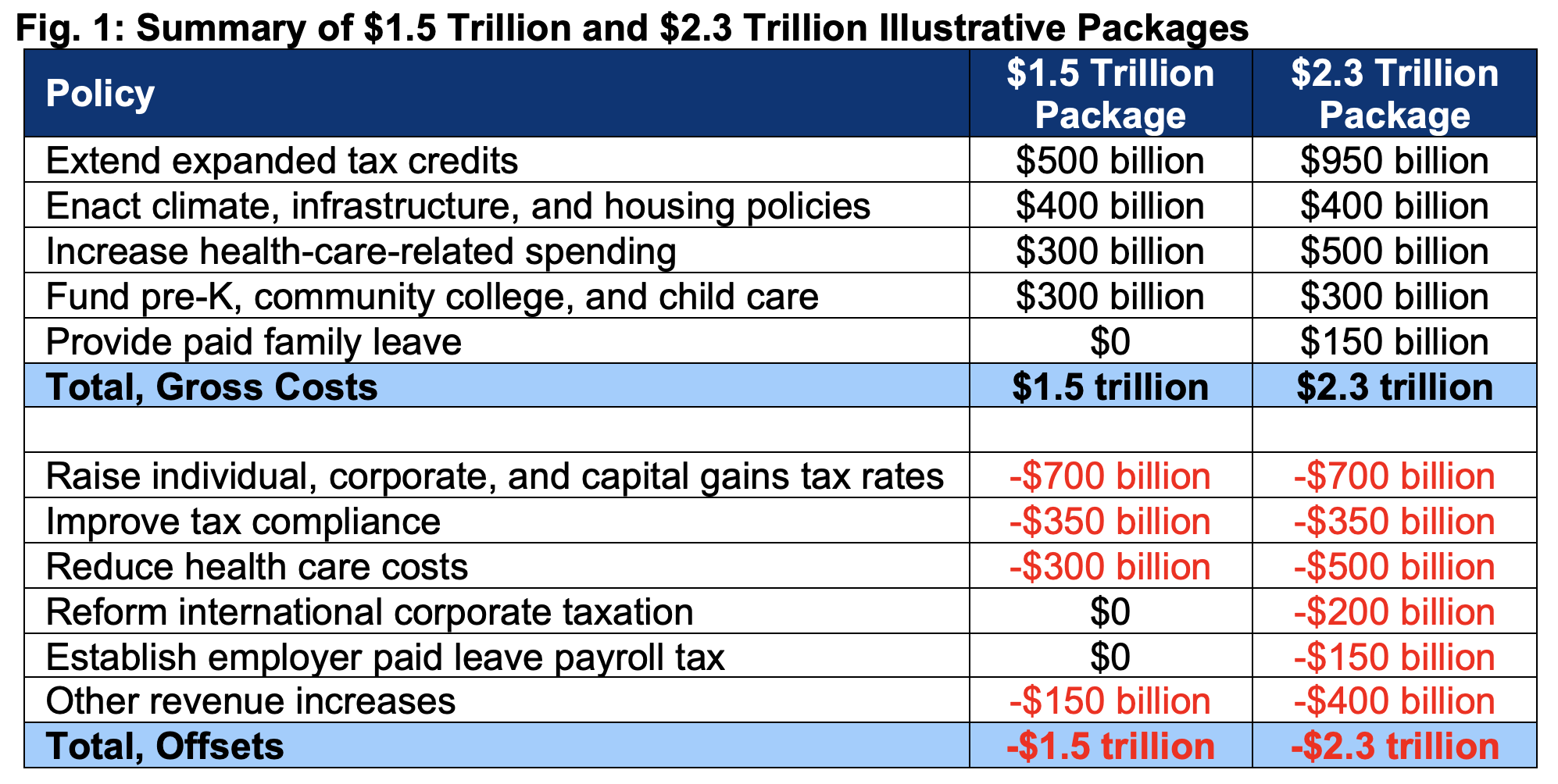

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Build Back Better Act Gift And Estate Tax Changes Davis Wright Tremaine

Tax Proposals Under The Build Back Better Act Version 2 0

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Outlook On Tax Changes Amid Numerous 2022 Challenges Our Insights Plante Moran

Estate And Gift Tax Laws In 2022 And The Build Back Better Act

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Estate And Gift Tax Laws In 2022 And The Build Back Better Act

The Build Back Better Act The Senate Bill True Partners Consulting

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

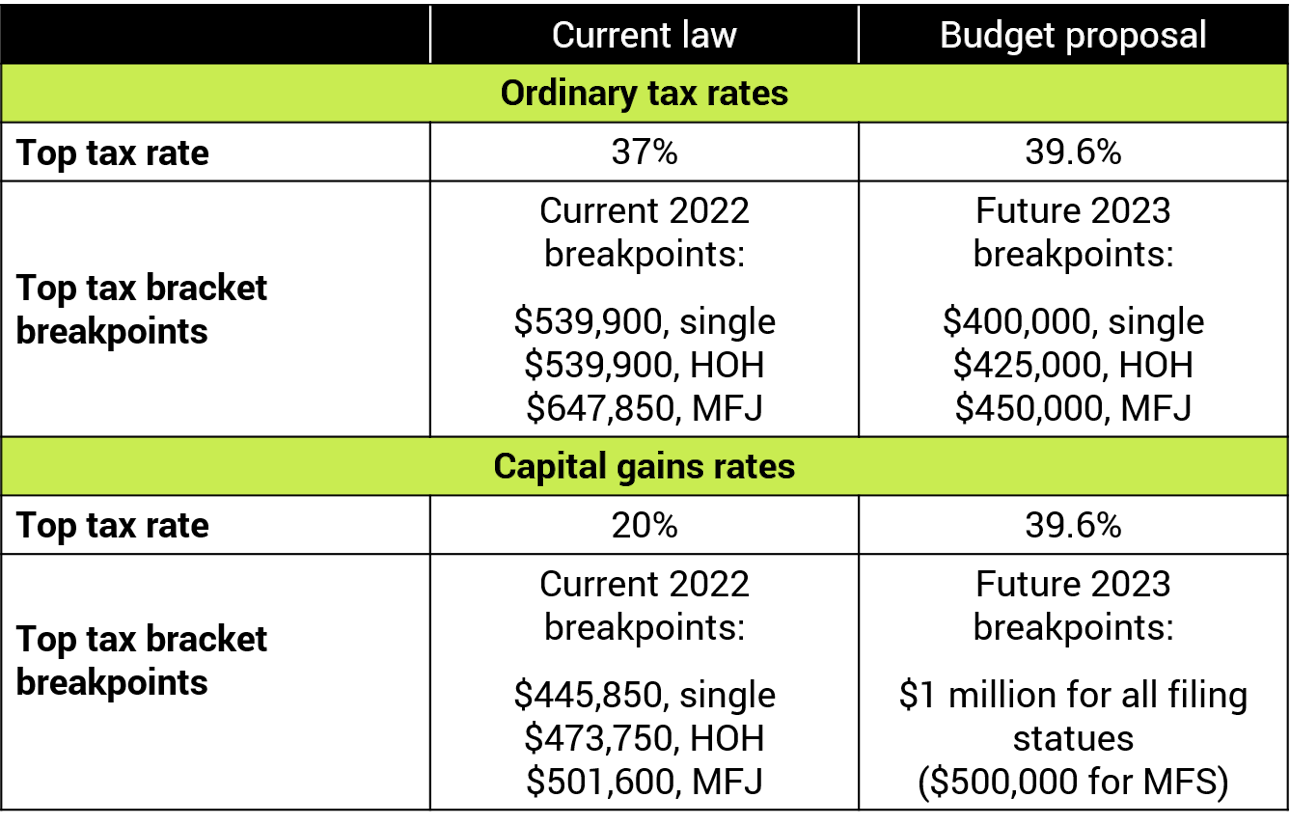

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now